NASA Revamps Commercial Space Station Strategy Amid Budget Issues

Introduction

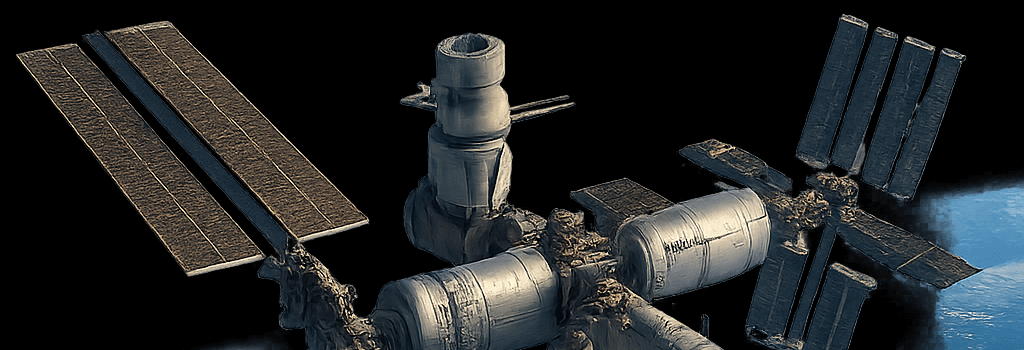

As NASA prepares to deorbit the International Space Station (ISS) around 2030, Acting Administrator Sean Duffy has signed a comprehensive directive to reshape the agency’s Commercial Low Earth Orbit Destinations (CLD) Program. With China’s Tiangong station operational and NASA facing up to a $4 billion budget gap, this policy pivot aims to accelerate U.S. presence in LEO via multiple commercially operated platforms.

Key Changes to the CLD Program

- Extended Space Act Agreements

NASA will continue to fund several companies under flexible Space Act Agreements rather than moving immediately to firm fixed‐price Federal Acquisition Regulation (FAR) contracts. - Open Competition

A full and open solicitation will launch within 6 months. NASA intends to award at least two—and ideally three—contracts for station development, each initially funded at milestone payments up to 75% until successful crewed demos. - Deferred Certification

Formal design reviews and acceptance testing shift to a post‐flight certification phase, reducing upfront requirements and allowing modular, iterative designs to reach orbit faster. - Reduced Minimum Capability

The threshold is now 4 crew for 1-month missions, down from a larger “full operational capability” target. This aligns with a minimum viable product approach and better matches current budgets.

Technical Integration and Docking Systems

One of the most challenging subsystems on any private station is the docking and berthing interface. NASA’s directive emphasizes compatibility with multiple vehicles:

- Crew Dragon (SpaceX) & Orion (Lockheed Martin) docking standards

- International Docking System Standard (IDSS) adapters

- SSERVI‐compatible robotic berthing ports for large‐module assembly via the Canadarm2

Key power and life‐support metrics: most proposals target 12–30 kW of usable power from deployable solar arrays, 3–5 kW life‐support loads per crew, and a pressurized volume of 100–300 m3 per module.

Budgetary and Policy Shifts

“How was NASA’s previous strategy going to work when they lost close to a third of their budget? They had no chance. This gives them a fighting chance.”

—Phil McAlister, former Commercial Space Division Director

Congress approved $272.3 million for FY 2026 and earmarked $2.1 billion over five years, significantly below the $4 billion anticipated. The new directive withholds 25% of milestone payments until a successful crewed in‐space demonstration—mitigating risk and tying funds to real performance.

Comparative Analysis of Commercial Station Architectures

- Vast/Haven-1: 8.4 m length, 4 crew for two‐week missions, 12 kW power, uses Dragon for life support, maiden flight planned 2025.

- Axiom Station: 70 m3 pressurized volume, modular add-ons (lab, habitation, docking), 12 kW solar arrays, in‐flight ISS demonstration scheduled 2027.

- Orbital Reef (Blue Origin/Voyager): 390 m3 volume, up to 12 crew, 100 kW solar arrays, planned factory assembly in Decatur, Alabama by 2028.

Risks and Opportunities

With only a few years until the ISS deorbit, NASA and industry must navigate:

- Orbital Mechanics: Deorbit burn using Dragon’s Draco thrusters in 2029 requires flawless ISS passivation.

- Supply Chain & Manufacturing: Carbon‐fiber pressured shells, avionics harnesses, and regenerative life support (ECLSS) systems all have multi‐year lead times.

- Regulatory & Safety: FAA licensing for commercial stations, NASA Technical Standard compliance, and interagency coordination to avoid orbital debris.

Looking Ahead: Industry Perspectives

Max Haot, CEO of Vast, notes that building a minimum viable product aligns incentives: “This approach mirrors the success of NASA’s cargo and crew phases—iterate quickly, demonstrate in orbit, then expand capability.”

Meanwhile, Northrop Grumman has merged its effort with Voyager Space, and Axiom continues development of habitation modules that will eventually detach from the ISS to form an independent station. All providers now face a strategic pivot to meet NASA’s revised requirements.

Conclusion

By adjusting both technical expectations and funding mechanisms, NASA aims to catalyze a thriving commercial LEO ecosystem. With the ISS’s end of life on the horizon, these policy and budgetary reforms will determine whether America maintains a continuous human presence in orbit—or cedes ground to international competitors.